how to put instacart on taxes

With TurboTax Live youll be able to get unlimited advice. Instacart delivery starts at 399 for same-day orders over 35.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Learn how to file your 1040 and reduce taxes as an Instacart shopper in.

. Be sure to file separate Schedule C forms for each separate freelance work that you do ie. By early January 2022. Put 20 away for the just in.

Accurate time-based compensation for Instacart drivers is difficult to anticipate. Same-Day Delivery Powered by Instacart is available to members in most metropolitan areas. Tax tips for Instacart Shoppers.

Instacart Shoppers weve put together a custom tax guide for you complete with insider tips from our tax specialists. This is part of the onboarding process. Up to 5 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed.

Fill out the paperwork. Weve put together some FAQs to help you learn more about how to use Stripe Express to review your. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Attend an in-person orientation. For the instacart expenses related to your vehicle you must decide whether to take mileage deduction flat 535 cents per business mile driven or actual expenses total costs for repairs. Choose a session in the app.

This includes self-employment taxes and income taxes. Getting started on Instacart is a simple process. Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. Get 1 FREE stock valued up to 1300 by opening funding a Webull brokerage account. Youll include the taxes on your.

To actually file your Instacart taxes youll need the right tax form. Top 10 Tax Deductions for Instacart Personal Shoppers 2022. You must make quarterly estimated tax payments for the current.

Knowing how much to pay is just the first step. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. The organization distributes no official information on temporary worker pay however they do.

The Instacart 1099 tax forms youll need to file. Paper forms delivered via mail may take up to an additional 10 business days. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Weve put together some FAQs to help you learn more about 1099s and. Your 1099 tax form will be sent to you by January 31 2022 note. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. Depending on your state youll likely owe 20-25 on your earnings from instacart. There will be a clear indication of the delivery.

Get the scoop on everything you need to know to make tax. Instacart partners with Stripe to file 1099 tax forms that summarize your earnings. Learn the basic of filing your taxes as an independent contractor.

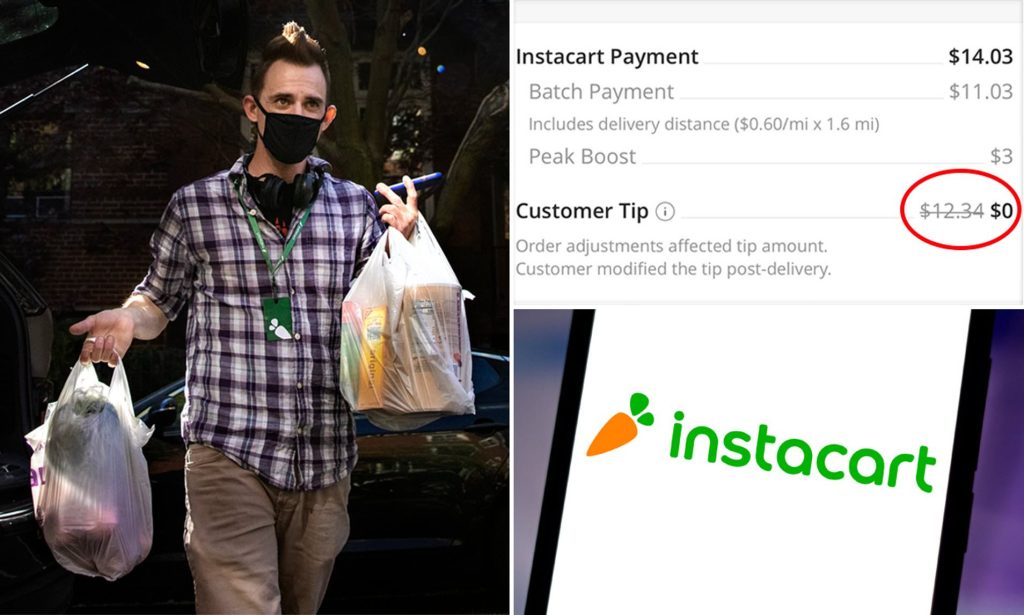

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Doordash Postmates Instacart Taxes Filing Gig Economy Taxes Youtube

Instacart Driver Review 10k As A Part Time Instacart Shopper

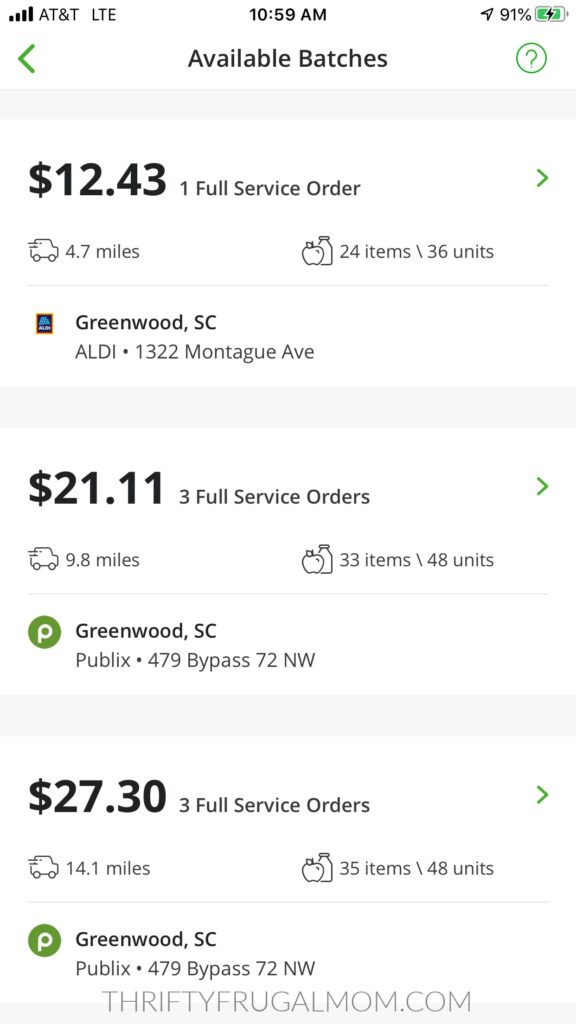

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

How To Make Money As An Instacart Shopper My Undercover Experience The Money Ninja

Instacart Tipping Etiquette How Much Am I Supposed To Tip

What You Need To Know About Instacart Taxes Net Pay Advance

How To Become An Instacart Shopper Driver Is It Worth It

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

How To Become An Instacart Shopper Pros Cons Pay Job Application

Instacart Driver Review 10k As A Part Time Instacart Shopper

Instacart Driver Pay How Much Does Instacart Pay Shoppers

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Instacart In California Every Other State R Instacartshoppers

Guide To 1099 Tax Forms For Instacart Shopper Stripe Help Support